The Company informs that Comisión Nacional de Valores (the Argentine National Securities Commission) and Buenos Aires Stock Exchange approved what has been decided in the Company’s Shareholders meeting held on April 27, 2023:

1) An increase in the capital stock in the amount of ARS 6,552,405,000, through the partial capitalization of the Issue Premium account, resulting in the issuance of 6,552,405,000 common shares, with a par value of ARS 1 (one peso) and with the right to one vote per share.

2) changing the nominal value of the ordinary shares from ARS 1 to ARS 10 each and entitled to one (1) vote per share.

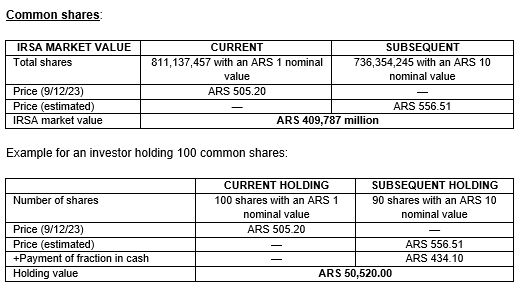

Having obtained the authorizations from the Comisión Nacional de Valores (the Argentine National Securities Commission) and from the Buenos Aires Stock Exchange, the Company informs all shareholders who have such quality as of September 19, 2023, according to the registry maintained by Caja de Valores S.A., that from September 20, 2023, the shares distribution and the change in nominal value will be made simultaneously and the entry of the change of 811,137,457 book-entry common shares, with a nominal value of ARS 1 each and one vote per share, for the amount of 736,354,245 book-entry common shares with a nominal value of ARS 10 each and one vote per share, consequently, a reverse split of the Company’s shares shall be carried out, where every 1 (one) old share with nominal value of ARS 1 shall be exchanged for 0.907804514 new shares with nominal value ARS 10. The new shares to be distributed due to the described capitalization will have economic rights under equal conditions with those that are currently in circulation.

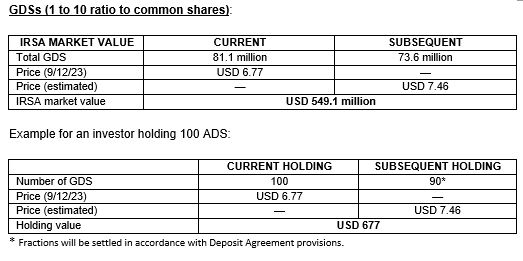

Also, regarding the GDS holders, we instruct BNYM to process the reverse split, at the same rate as mentioned above for the ADR program, effective October 3, 2023.

Regarding the shareholders who, because of the entry in the Scriptural Registry, have fractions of common shares with a nominal value of ARS 10 and one vote per share, they will be settled in cash in accordance with the listing regulations of Bolsas y Mercados Argentinos. Regarding the shareholders who, due to the exchange of shares did not reach at least one share with a nominal value of ARS 10, the necessary amount will be assigned to them until the nominal value of ARS 10 is completed.

It is reported that the Company share capital after de indicated operations will amount to ARS 7,363,542,450 represented by 736,354,245 book-entry common shares with a nominal value of ARS 10 each and one vote per share.

Likewise, the Buenos Aires Stock Exchange has been requested to change the modality of the negotiation of the shares representing the share capital. Specifically, the negotiation price will be registered per share instead of being negotiated by Argentinean peso (ARS) of nominal value, given that the change in nominal value, and the issuance of shares resulting from the capitalization, would produce a substantial downward effect on the share price.

It should be mentioned that this capitalization and change in the nominal value of the shares do not modify the economic values of the holdings or the percentage of participation in the share capital. Likewise, and for the purpose of clarification, some examples are detailed below, where the effects of capitalization and change in nominal value are assumed, and effects on the price are not considered for market reasons: